Dubai stands as a modern global business hub, welcoming foreign investors and enterprises with open arms. Situated within the United Arab Emirates (UAE), this city-state offers abundant business opportunities. However, akin to any nation, Dubai enforces specific regulations for business operations. Therefore, the need for Dubai Import Code becomes crucial.

To operate a business in Dubai, one essential requirement is obtaining an Import Code Dubai, also known as a Dubai Customs Code. In this blog, crafted by Shuraa Business Setup, we delve into the significance of having an Import Code Dubai and highlight its indispensability. Additionally, we outline the step-by-step procedural requirements for acquiring this code.

What is an Import Code Dubai?

For businesses aiming to import goods into Dubai, having an import code is crucial. The approval process for this code is managed by Dubai Customs, which meticulously reviews applications from interested enterprises. Possessing this Dubai Customs code ensures a smooth and legal clearance process for imported goods through customs.

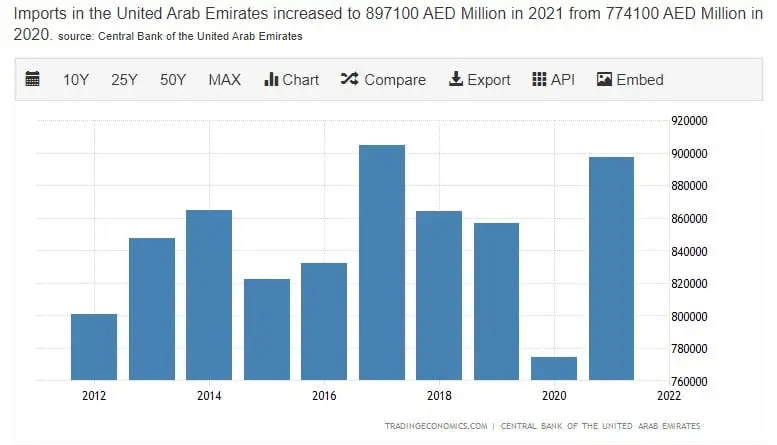

The UAE is widely recognized as a premier global business hub by investors and businesses worldwide. This reputation is attributed to its transparent and straightforward taxation policies, robust infrastructure, and advantageous geographical positioning. Additionally, the UAE government consistently introduces initiatives to enhance business activities, particularly through the establishment of free zones.

Who Is Eligible to Apply for an Import Code?

A valid trade license is fundamental for applying for and acquiring an import code in Dubai. To be eligible for a customs code application, you must possess one of the following types of trade licenses:

Applicants may also utilise a governmental notification to apply for an import code Dubai in certain exceptional circumstances.

If you currently lack a trade license, it is imperative to obtain one before initiating the import code application process. You can swiftly acquire your trade license by submitting the requisite documents and fees through the Dubai Economy & Tourism Department (DED) website.

What’s the Purpose of a Dubai Customs Code?

Dubai Customs rigorously adheres to the regulations outlined in the Gulf Cooperation Council (GCC) Customs Tariff Codes and policies. The customs authorities in Dubai and the UAE remain vigilant in enforcing import regulations and preventing the importation of prohibited goods.

A Dubai customs code serves as a specialised import license for your business. This code enables authorities to track your business’s imports, oversee your compliance with customs regulations, and verify the accurate payment of import duties.

Benefits of Obtaining Dubai Import Code

Below are the advantages of obtaining an import code in Dubai:

1. Compliance with Legal Requirements

Acquiring an import code in Dubai is imperative to fulfil legal obligations. While the UAE government welcomes businesses and foreign investors, adherence to regulations is strictly enforced, making possessing an import code essential for compliance.

2. Mitigation of Customs Penalties

Possessing a valid import code in Dubai reduces the risk of facing costly customs penalties. This code is evidence of legal importation practices, ensuring smooth transactions within the customs framework.

3. Streamlined Customs Clearance

A valid import code in Dubai expedites customs clearance, which can otherwise be time-consuming and intricate. With this code, the customs authority efficiently processes imported goods, eliminating the need for separate approvals and saving valuable time and resources.

4. Enhanced Supply Chain Management

Utilising a Dubai customs code enables efficient tracking of imported goods through customs, thereby enhancing overall supply chain management capabilities.

5. Access to Dubai’s Free Zones

Access to Dubai’s Free Zones, offering various benefits such as foreign ownership, tax exemptions, and profit transfer flexibility, requires an import code Dubai. This code is a prerequisite for establishing businesses within these economic zones and availing their advantages.

Understanding the significance of possessing a valid Dubai customs code, let’s explore the process of obtaining one upon establishing a new import-export business in Dubai.

Step-by-Step Guide to Obtain Your Import Code

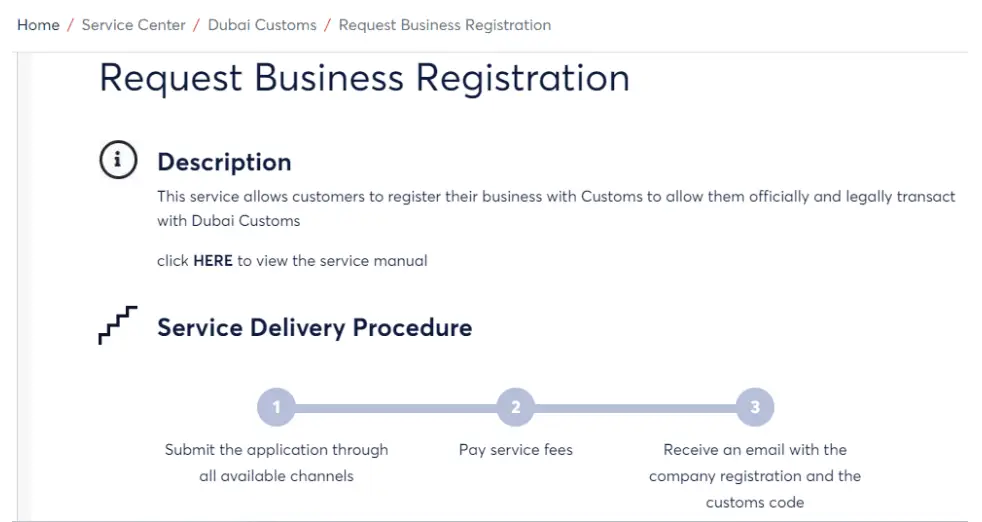

Initiating your application for an Import Code in Dubai with Dubai Customs is a straightforward process through the eService portal. You can anticipate approval within one business day, assuming all documents are in order. Here’s a breakdown of the procedure to obtain your Dubai Customs code. It’s noteworthy that the process is similar to the renewal of the Dubai Customs code, a topic we’ll also cover.

Step 1: Gather Required Documents for Applying for an Import Code Dubai

Ensure you have all necessary documents before applying for your customs code to prevent procedural delays. Here’s what you’ll need:

- Valid Copy of Trade or Commercial License

Obtain a valid copy of your trade or commercial license from the Dubai Economy & Tourism Department (DED).

- Copy of Valid Passport

Provide a copy of your valid passport. If your business has multiple partners, include copies of their passports.

- Emirates Post License (Optional)

If you wish to receive documents via courier service, include a copy of your Emirates Post License.

Note:

- Submitting passport copies is mandatory for new import code Dubai applications.

- For Dubai customs code renewal, passport copies are not required. However, ensure you have valid copies of your trade and Emirates Post licenses.

Step 2: Application Fees for Your Import Code

When submitting your application for a Dubai Customs code, it’s crucial to be aware of the following fees:

- New Application:

- Total Fee: AED 120

- Application Fee: AED 100

- Knowledge and Innovation Fees: AED 20

- Dubai Customs Code Renewal:

- Fee: AED 25

Step 3: Applying Online

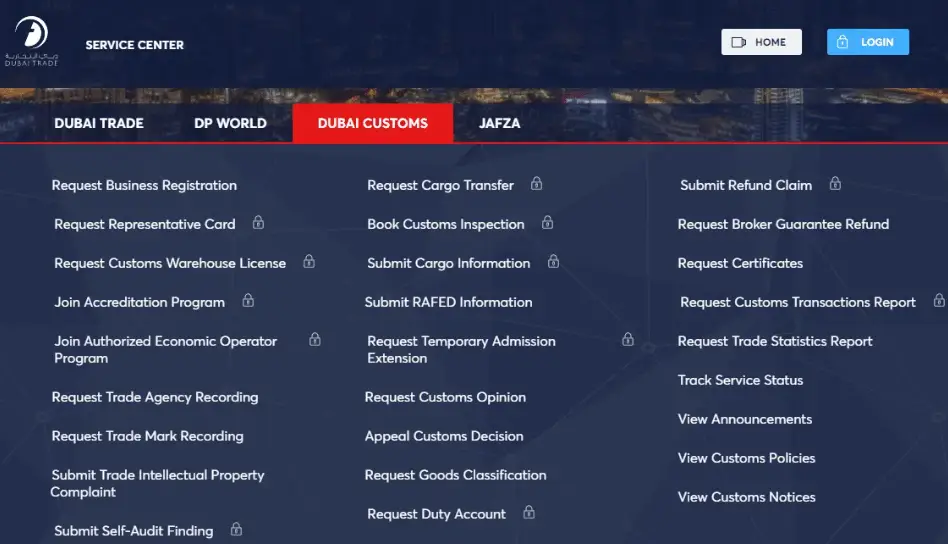

Access the online service portal of Dubai Customs through the Dubai Trade website. Head to the Service section of the website and select “New Business Registration” under the Dubai Customs tab.

Here, you’ll discover the prerequisites and cost details for applying for your Import Code Dubai.

Upon receiving your unique customs code, it remains valid for 60 days (about 2 months). Therefore, renewing it within this period is crucial to ensure its continued functionality.

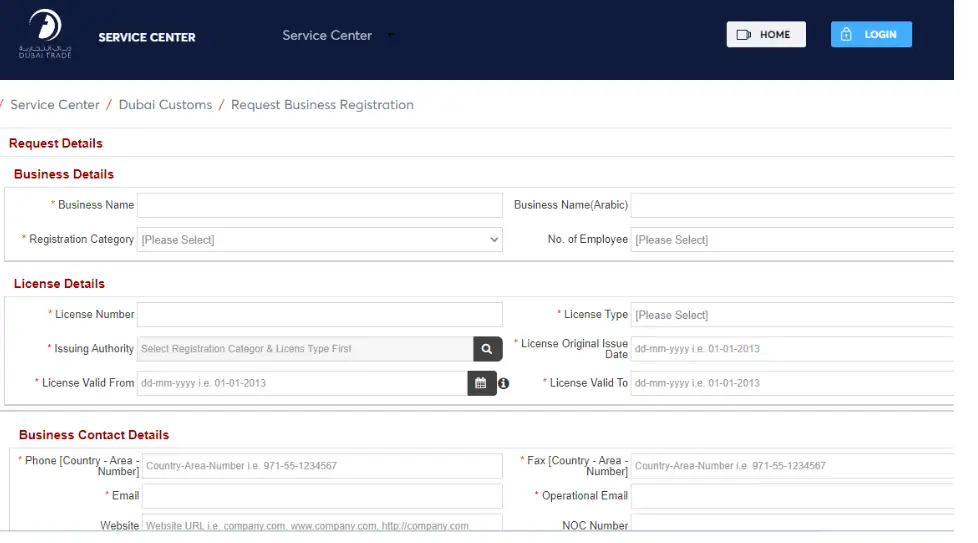

To register your business with the Dubai Customs portal, ensure you provide the following details:

- Business Information

- Business name in English and Arabic (optional)

- Select “Dubai-based company” from the registration category drop-down menu

- Specify the number of employees by selecting a range

- License Details

- License number and type

- Issuing authority

- Issue date and validity period

- Business Contact Details

- Phone and fax numbers (mandatory fields)

- Email address

- Business website and NOC for the applicant applying for the customs code.

After entering all the required information, you can save your application as a draft for later completion or proceed to the next step. The system will prompt you to upload relevant documents. Once uploaded, click “Next” to proceed to the payment page and submit your application.

Step 4: Monitoring Your Application

Once you’ve submitted your application, expect approval within one business day if all documents are in order. Subsequently, you can utilise the same portal for renewals or amendments.

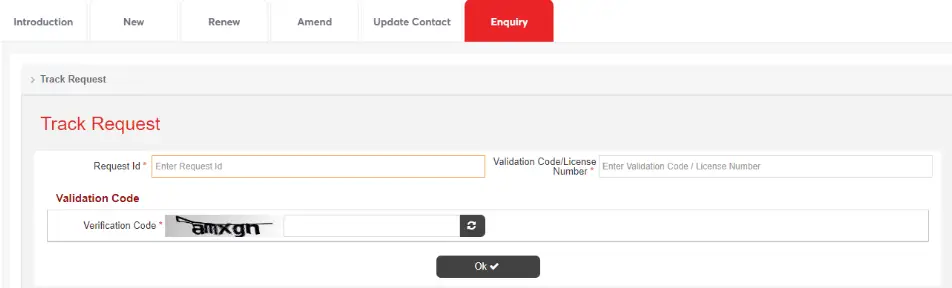

Furthermore, if you have any inquiries regarding your application or the process itself, you can submit them through the portal. Each query will be assigned a Request ID, enabling you to track its status at your convenience.

How to Renew Your Dubai Customs Business Code

Before initiating the Business Code Renewal process, ensure your contact details are up-to-date and verified through the e-Service “Manage Contact Details.”

Follow these steps for the renewal of your Dubai Customs Business Code:

- Visit www.dubaitrade.ae.

- Navigate to the Service Centre and select Dubai Customs > Registration Tools > Renew Business Code.

- Enter the Business Code and the system-generated captcha, then click OK.

- Adjust the expiry date to align with your trade license validity and set the renewal date as the current date.

- Upload copies of your trade license and passport.

- Save the changes by entering the system-generated captcha and submit the renewal request for approval.

Prohibited Items in Dubai: Regulations and Approval Requirements

Here are the regulations and approval requirements:

- The International Trade Administration of Dubai enforces restrictions on certain items for import or export.

- Prohibited items are not covered by your import code Dubai.

- Approval from specific regulatory bodies is necessary before trading these items.

- Examples of prohibited items include:

- Agro products like plants, live animals, and fertilisers require additional permission from the Ministry of Climate Change and Environment.

- Pharmaceutical or medical products need approval from the Ministry of Health & Prevention.

- Telecommunication and wireless communication equipment necessitate approval from the Telecommunications Regulatory Authority.

- Alcoholic beverages, demanding permission from Dubai Police.

- Processed food and personal hygiene products mandate prior approval from Dubai Municipality. Additionally, obtaining approval for these items may involve submitting a product sample and paying for a lab test.

Streamlining Procedures with Expert Guidance

Acquiring an import code in Dubai is essential for legally importing goods into Dubai or the UAE for your trading or commercial activities. Fortunately, the process of obtaining or renewing a Dubai Customs code is streamlined when all necessary documents are prepared for your export-import business in Dubai.

Leveraging investor-friendly economic policies and robust infrastructure support, the UAE emerges as an appealing destination for trading businesses. Not sure where to start? Obtain professional assistance from Shuraa Business Setup today. Contact us at +971 4 4081900, reach out via WhatsApp at +971 50 7775554, or email us at [email protected] for comprehensive support in launching your business ventures in Dubai.

FAQs

Q1. What is the purpose of the Dubai Customs Code?

The Dubai Customs Code ensures compliance with regulations set forth by the Gulf Cooperation Council (GCC) Customs Tariff Codes and policies. It facilitates legal importation while preventing the entry of prohibited goods.

Q2. What are the advantages of obtaining an Import Code Dubai?

Acquiring an Import Code Dubai ensures compliance with legal requirements, mitigates customs penalties, expedites customs clearance, enhances supply chain management, and provides access to Dubai’s Free Zones.

Q3. How can I apply for an Import Code Dubai?

You can initiate your application online through the Dubai Customs portal, ensuring all required documents are prepared and fees are paid.

Q4. How do I renew my Dubai Customs Business Code?

To renew your Dubai Customs Business Code, update and verify your contact details, then follow the renewal process outlined on u003ca href=u0022http://www.dubaitrade.ae/u0022 target=u0022_blanku0022 rel=u0022noreferrer noopeneru0022u003ewww.dubaitrade.aeu003c/au003e, ensuring compliance with your trade license validity.